Property and Casualty (P&C) insurance companies have enjoyed consistent annual premium growth rates of 6-8% since 2018, leading to reliable and increasingly positive financial results. However, negative macroeconomic trends, including geopolitical conflict, environmental challenges, and inflation are changing the nature of risk and creating pressure on the sector.

Now more than ever, commercial carriers need to rely on their data as markets move lightning-fast in reaction to news. It’s not just enough to use data to improve investment functions or customer service. Now insurers need to use their data to elevate their risk and liquidity analytical capabilities so they can compete on more than just offered rates.

The nature of risks to all of us is changing, especially in the areas of natural catastrophes, carbon net-zero, supply chains, and cybercrime.

Two aspects of insurance that are rife for additional analytics are decarbonization and natural catastrophes. Let’s start with analyzing portfolio emissions.

The insurance industry will play a major role in reducing carbon emissions. Economic investment is driven partially by insurance coverage. The Net Zero Insurance Alliance (NZIA) is a group of 30 global P&C insurers committed to reporting on the CO2 emissions of their underwritten portfolios while setting near-term reduction guidelines for 2030. This means that carriers will gravitate towards industries with lower emissions and a faster path to becoming carbon-neutral.

This will positively affect insurance rates in faster-greening industries and mean higher premiums for those that are slow to change their emissions intensity. To successfully compete and help their customers’ environmental mission, commercial carriers will need to augment their data and analytical capabilities in the areas of underwriting and portfolio management.

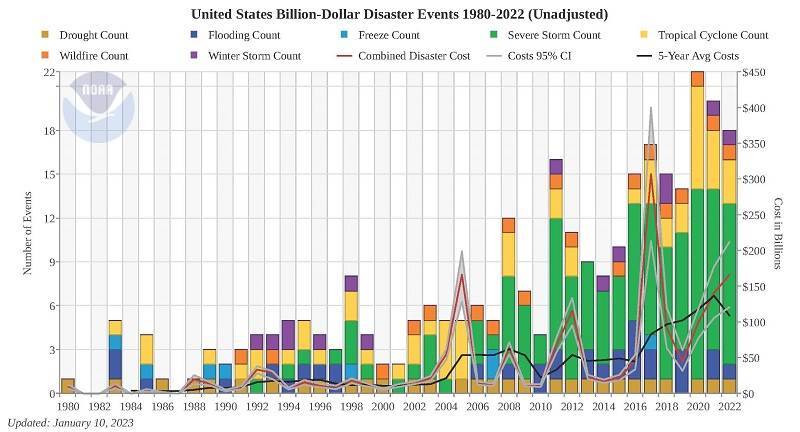

For natural catastrophes (NatCats), the chart above from NOAA shows that billion-dollar events are increasing in number and severity over time.

When it comes to policy pricing, insurance tends to react to singular weather events, making coverage much more expensive (and sometimes unaffordable) to customers the following year. Carriers need to change the way they price policies by leveraging outside and weather data to predict if the event was a one-off or part of a larger approaching pattern of NatCats.

Besides using advanced algorithms for risk analysis, P&C companies can differentiate themselves by sharing their knowledge and alerting customers with fleets of airplanes or ships to move them out of the way of impending extreme weather. With better understanding of weather and risk, P&C carriers can also expand into services that help their customers harden supply chains or guide them through the myriad of ESG frameworks to reduce overall risk.

Long-term challenges for commercial P&C carriers are ahead, but by organizing and modeling their vast amounts of data to innovate differentiating services and offerings, they will be able to carve out a more valuable niche for their customers and bring safety to more people and organizations.

If you are interested in learning more about how LRS can help you find value in your data using modern data architectures to implement advanced analytical applications, please contact us to request a meeting.

About the author

Steve Cavolick is a Senior Solution Architect with LRS IT Solutions. With over 20 years of experience in enterprise business analytics and information management, Steve is 100% focused on helping customers find value in their data to drive better business outcomes. Using technologies from best-of-breed vendors, he has created solutions for the retail, telco, manufacturing, distribution, financial services, gaming, and insurance industries.